M&A Barometer – March 2023

Philippe Hottinguer Finance presents its monthly barometer of M&A activity for March 2023.

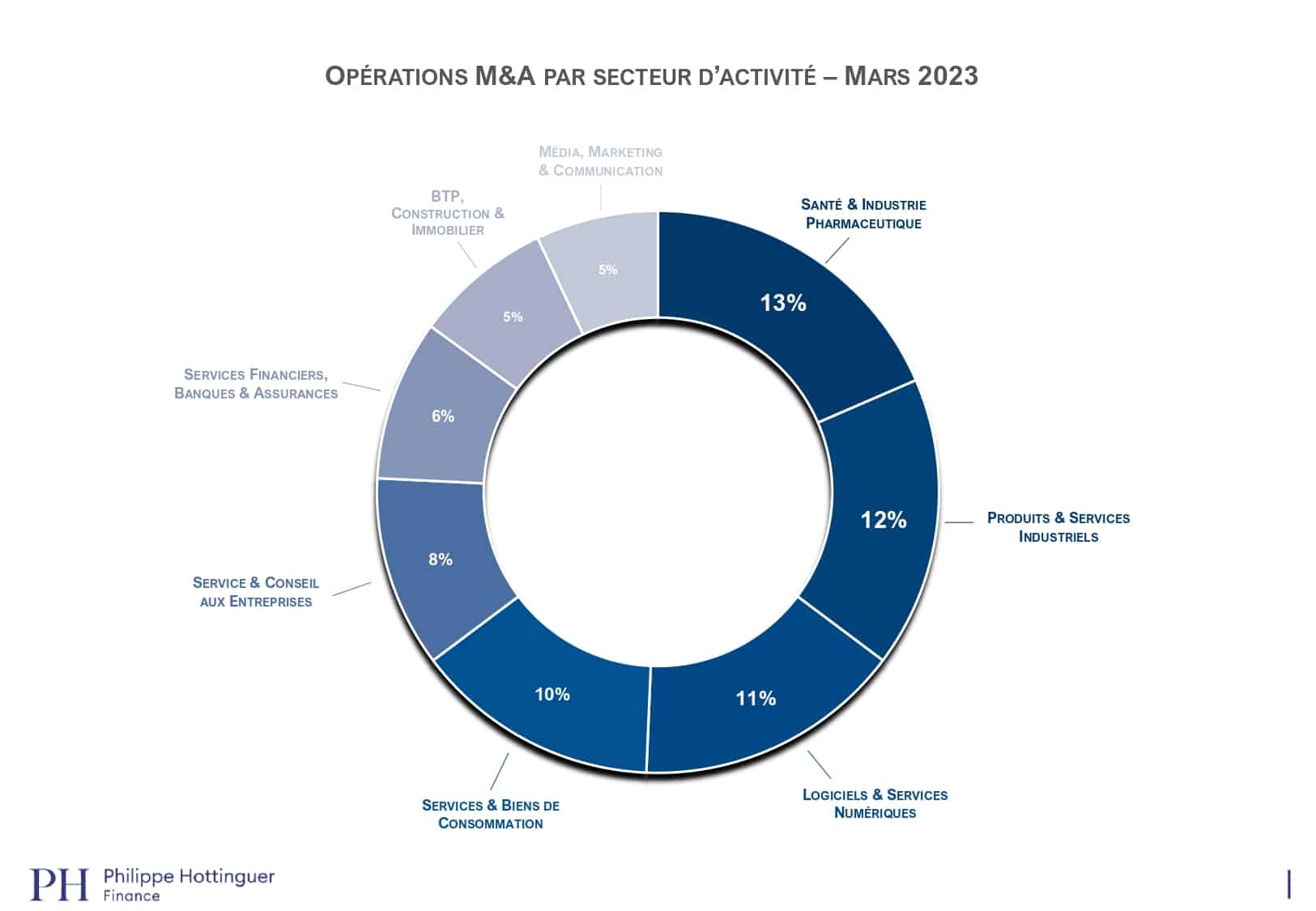

This month, of the 330 deals identified by our team, the healthcare and pharmaceuticals sector was the most dynamic. Manufacturing and software companies are also generating strong M&A activity, with the latter sector benefiting from significant fundraising.

Top 4 sectors:

- Health & Pharmaceuticals (13%)

- Industrial Products & Services (12%)

- Software & Digital Services (11%)

- Services & Consumer Goods (10%)

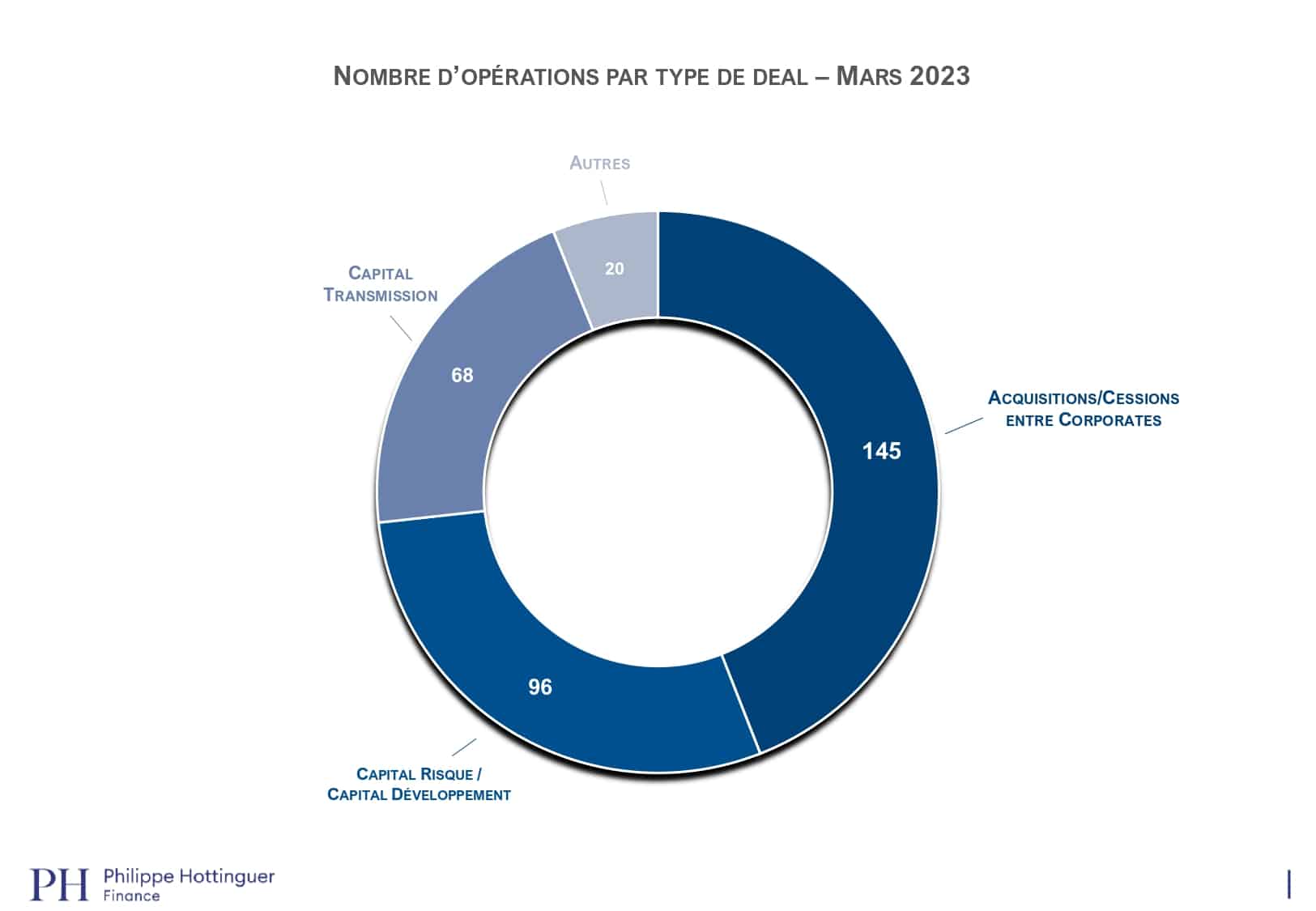

The majority of deals were corporate-to-corporate acquisitions/divestitures (44% of deals), followed by VC and expansion capital (29%), and buyouts (21%).

Deal of the month:

French technical glove manufacturer PIERCAN signs a primary LBO, with the founders entrusting the majority of the capital to the Merieux Equity Partners fund, accompanied by Siparex.

PIERCAN key figures:

- 📈 CA 2022: €39M

- 👨🔧 Workforce: 250 employees (in France and the USA)

- 💰Valuation: between €170m and €200m